Why does Volatality Index change drastically during election time?

- 8sapience

- Index , Pre Market

- 17 May, 2024

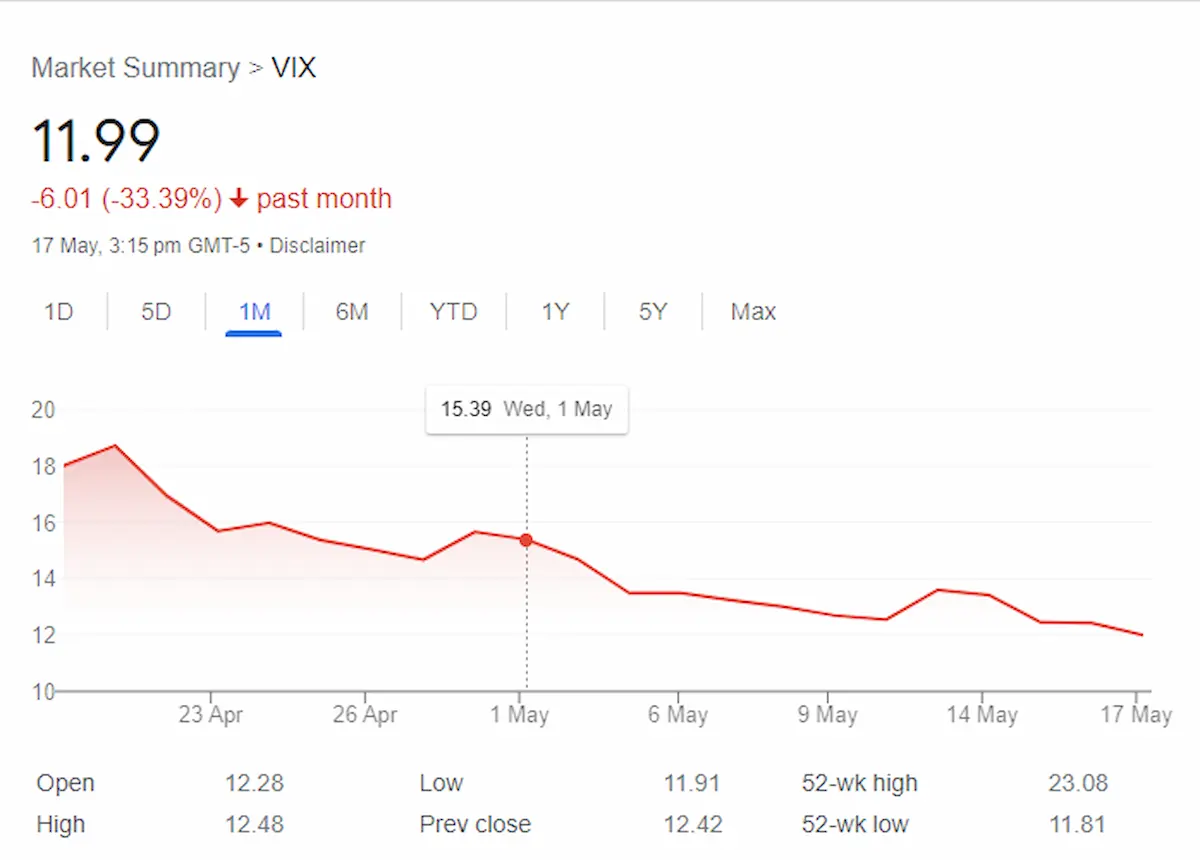

VIX (Volatility Index - Fear Index) is one of the key metric that measures market volatility.

It was crashed 20% to sub 10 levels on 23rd April,2024.

What is VIX and how it is calculated?

VIX is calculated using the best bid and ask quotes of out-of-the-money near and mid-month Nifty option contracts. Traders’ expectations of volatility over the next 30 days are reflected in the VIX, with a lower VIX indicating low expectations of volatility and vice versa.

Explain me like 6 year old,

VIX measures how fast the piggy bank (stock market) is filling up.When there’s a lot of money going in quickly(stock prices are changing up or down), the VIX goes up. When things are calmer and the piggy bank fills up slowly (stock prices aren’t changing much), the VIX goes down.

Why is VIX shooting up again?

Amid investor concerns related to how a low voter turnout can impact the outcome of the Lok Shabha elections, @SENSEX_BSE has lost over 2,000 points in May, 2024.

Did it also happen in the past?

Back in the 2014 Lok Shabha elections, VIX has started to spike towards the end of March and went up to levels of 36-38 until the results date and in 2019 also it has gone up levels of 30.

What does the present VIX movement indicate based on the above thesis?

The current VIX suggests that there is no surprise expected from the results.

What should be the strategy during such time?

The best thing to do is to reduce the aggression on the long side and stick to quality names on the delivery side and probably wait out this month for the storm to settle down.